To promote economic development, the Village of Goreville has created a Tax Increment Financing (TIF) district. Developers who plan to construct or renovate in a TIF district are able to receive some reimbursement for the development from dollars that would be paid to property taxing districts because of the increase valuation of the property with the improvements.

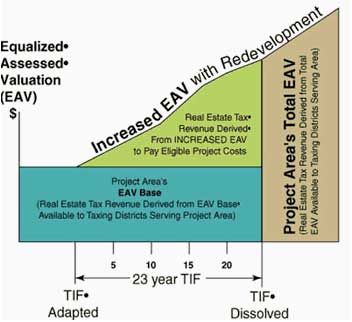

For TIF purposes, the value of property is documented prior to the time that improvements are made. After improvements, the increased value of the property due to the improvements is the “increment” part of TIF.

Developers of property in TIF districts must pay in the increase in property taxes resulting from the improvement, but the amount of taxes resulting from the improvements (the increment) is held in escrow in a special account by the Village until activities commence that are reimbursable and when dollars in the increment are sufficient to allow for reimbursement.

The developer’s share of the increment is determined when the developer and the Village enter into a redevelopment agreement before the project is started.

After property tax increases due to the improvements are paid by the developer, they may apply annually for reimbursement by presenting paid tax bills and receipts for possible reimbursable expenses to the Village Clerk. These are then certified by TIF consultants and approved for payment by the Village board.

The following types of activities may be reimbursed using TIF revenues:

Studies, surveys, and planning activities completed by professional services, such as architects, engineers, attorneys, among others.

Acquisition of property and its preparation, such as demolition and grading of land.

Reconstruction or remodeling of existing buildings and fixtures exceeding $30,000.

Construction of public works, i.e. water and sewer, as well as improvements.

Costs of job training and retraining.

Certain amounts of financing costs, including construction and bond interest.

EXAMPLES OF TIF-ELIGIBLE EXPENSES

- Land acquisition

- Demolition

- Rehabilitation or repair of existing buildings

- Job training programs

- Relocation costs

- Studies, surveys and plans

- Qualified interest costs

- Professional services such as architectural, engineering, legal, marketing and financial planning

To find out more or to receive a TIF information packet, contact, TIF administrator, Aggie Paul at the Village Hall at 618-995-2157.